Jennifer Troncone

Jennifer Troncone

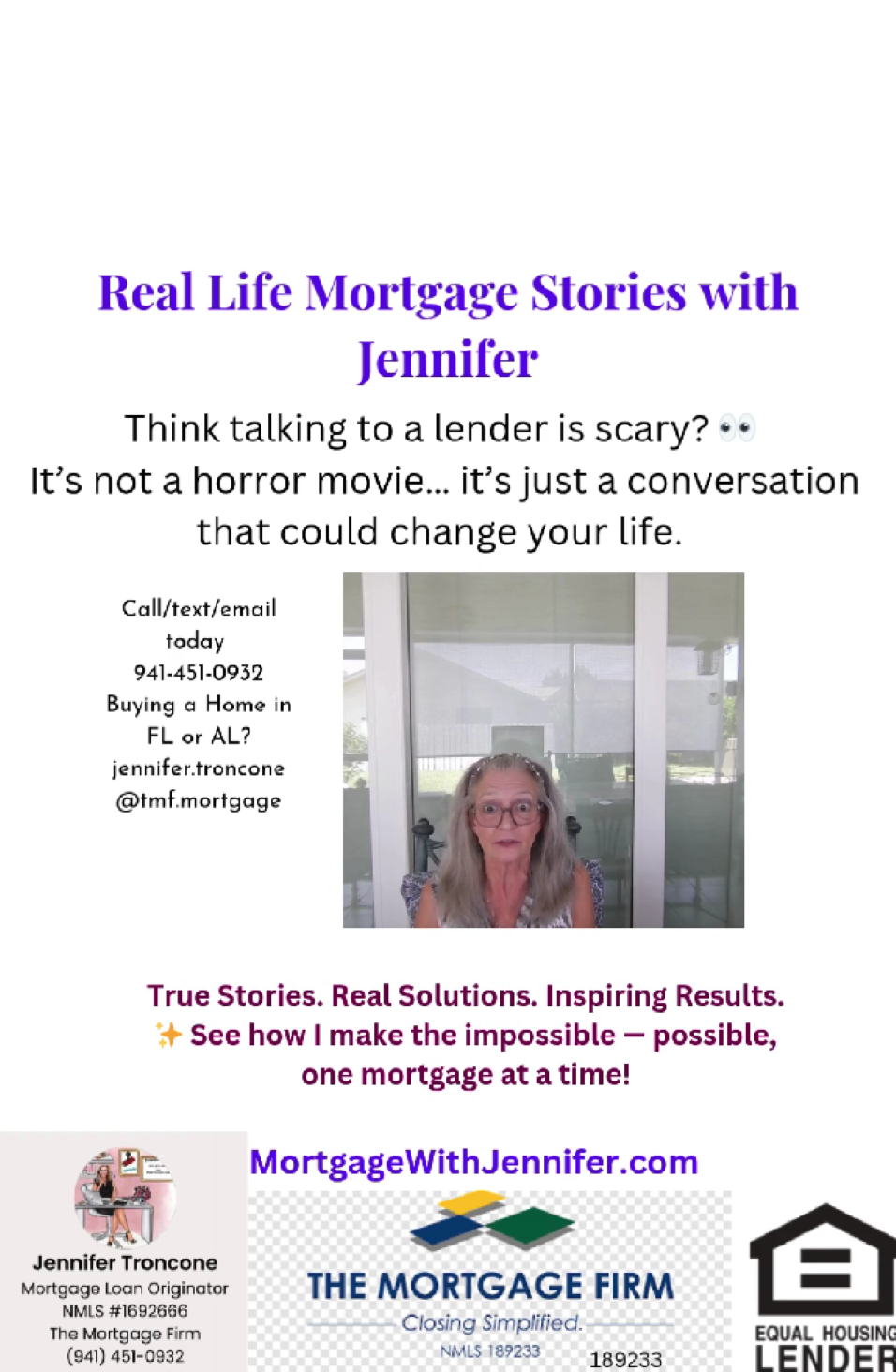

Hi! I’m Jennifer Troncone and I am a part of The Mortgage Firm team. As a mortgage professional, I understand that purchasing a home is a life-changing event. I would love to share this exciting experience by working alongside you. With my experience, I can assure you that the entire process will be smooth and simple. If you have any further inquiries, please feel free to give me a call and you could be one step closer to owning your new home.

Check out our videos

Your Pre-Approval Letter

Big banks only do specific loans!

New Build Lender

You do NOT need to use your builder's lender!

New ITIN Complete

If you can't find a lender to help you, I am here for you!

First Time Homebuyer

It’s a buyer’s market, and you have more power than ever. From down payment assistance programs and low-down conventional loans to exclusive buyer incentives, there are options to make homeownership more affordable. With the right program and the right team, your dream home could be within reach.

No You Cannot Use the Money in Your Mattress

Change Your Loan Type

Canva Scary Lender

DPAs

Free Guides & Resources

Our favorite kind of buyer? A confident one. Brush up on your loan knowledge, get an accurate quote, and let's get to it.

Mortgage Calculator

No more ballparks or rough estimates. Find out your all-in mortgage payment.

Disclosure

This material is provided for general and educational purposes only. It is not intended to provide legal, tax, or investment advice.

We're Talking About It

Get the scoop on market trends, lending insights, and strategies that work. For relational agents, curious buyers, and anyone else who appreciates quality information without the weird vibes.

5 Benefits of VA Loans for Veterans & Military Families The Real Value of a VA Loan The VA loan program was designed to remove common barriers to homeownership and honor those who have served. Wheth...

Read more...

Traditions To Foster Gratitude In Your Home Gratitude can transform how a home feels. It’s not about big gestures or perfect routines—it’s the small, intentional moments that make life inside your hom...

Read more...